Export control is a crucial aspect of international trade, designed to regulate and monitor the movement of goods across borders to ensure national security, prevent the proliferation of weapons, and safeguard economic interests. Product classification plays a pivotal role in export control, as it involves categorizing goods based on their nature, characteristics, and intended use. This classification is essential for determining the applicable export controls, licensing requirements, and compliance with international agreements.

Purpose of Product Classification

Product classification serves several key purposes in the context of export control. It ensures adherence to national and international regulations governing the export of specific goods. It also facilitates compliance with export control regimes such as the Wassenaar Arrangement, the Missile Technology Control Regime (MTCR), and the Nuclear Suppliers Group (NSG). Classification supports non-proliferation efforts by identifying goods that could contribute to developing weapons of mass destruction or destabilizing global security.

Strict controls on classified items help prevent the spread of sensitive technologies to unauthorized entities. Proper classification mitigates risk, as it identifies potential risks associated with exporting sensitive or controlled goods, including dual-use items with civil and military applications.

It also facilitates efficient customs procedures during the shipping process by providing clear and standardized classification codes for different products. It enables customs authorities to identify and monitor goods for compliance with export regulations.

Harmonized System (HS)

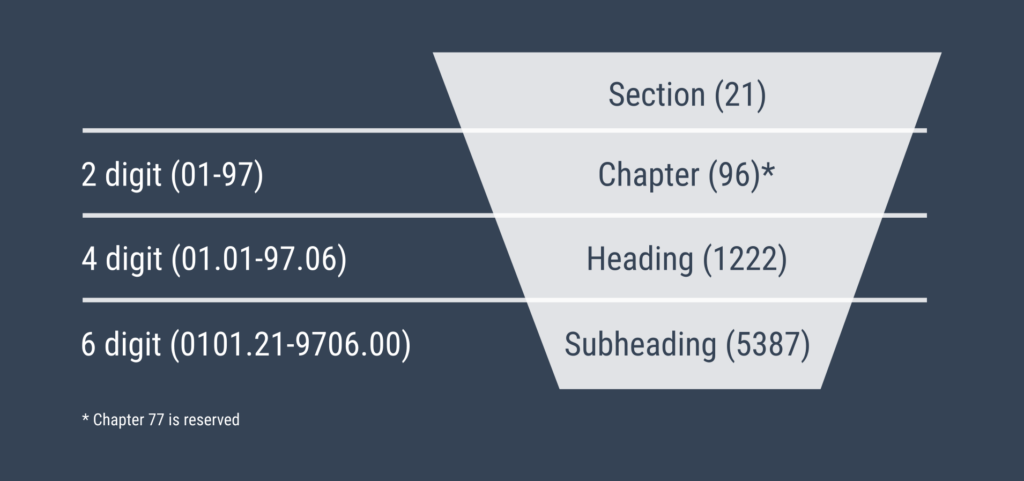

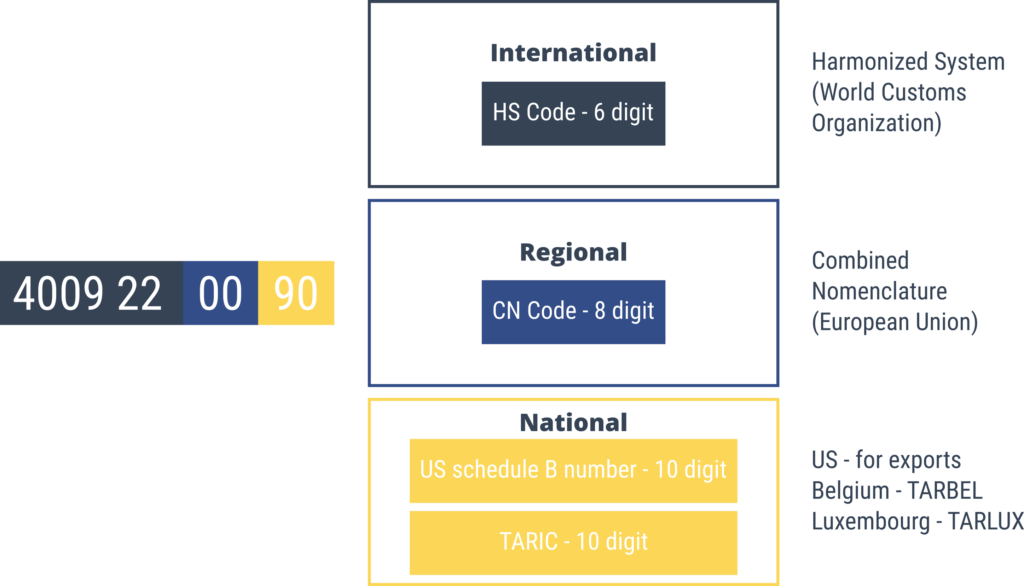

The basis of product classification lies with the Harmonized System (HS), which is an internationally standardized system of names (descriptions) and numbers (codes) for classifying traded goods. The HS is a product nomenclature where each product is assigned its corresponding “6-digit” code. The Harmonized System has been developed by the World Customs Organization (WCO) and is used for customs and trade purposes, facilitating international trade by providing a common language for product classification. Over 200 countries, customs, and economic unions, representing more than 98% of world trade, use the HS.

The HS code is hierarchical, with the first two digits representing the chapter, followed by more specific categories in subsequent digits. This systematic structure allows for comprehensively classifying a wide range of goods.

Countries that have adopted the Harmonized System are not permitted to alter in any way the descriptions associated with a heading or a subheading, nor can the numerical codes at the four—or six-digit levels be altered. This is what keeps the Harmonized System harmonized. Many countries, however, supplement the HS code with additional national classification systems, often referred to as tariff or schedule numbers. These systems provide more granularity and specificity in classifying products for domestic regulatory purposes.

The tariff classification of merchandise under the Harmonized System is governed by the principles outlined in the General Rules of Interpretation(“GRIs”).

The European Union (EU) has created a goods nomenclature called “Combined Nomenclature” (CN) to meet the requirements of both the Common Customs Tariff and the EU’s external trade statistics. It is closely related to the United States’ Harmonized Tariff Schedule.

The CN is based on the HS system. Each CN number has eight digits, the first six of which are represented by the code numbers relating to the HS headings and subheadings, and the seventh and eighth digits identify the CN subheadings. The EU Commission adopts a complete version of the combined nomenclature each year.

An integrated tariff has been established based on the combined nomenclature. The TARIC (Integrated Tariff of the European Communities) includes the provisions of the HS and CN but also additional provisions specified in EU trade legislation, such as tariff suspensions, tariff quotas, and tariff preferences, which exist for most of the EU’s trading partners. The 10-digit TARIC code must be used in trade with third countries in customs and statistical declarations.

Export Control Classification Numbers (ECCN)

Certain products and technologies, such as advanced technologies, encryption software, or sensitive materials, have been designated as strategic goods and technologies and are subject to stringent export controls due to their nature or technical specifications.

To pinpoint these products, Export Control Classification Numbers (ECCN) have been developed by countries or international organizations. ECCNs provide a more detailed classification beyond the HS code. Most often, these can be found in lists which are specific for defence-related products and dual-use items.

The US Munitions List and, at the European level, the EU Common Military List identify goods designed for military use, including weapons, ammunition, and related technologies. Strict controls and licensing requirements are applied to items on the munitions list.

Dual-use items (including hardware, software, and technology) have both civilian and military applications and are increasingly subject to control. Regulations for dual-use items include the US Commerce Control List (CCL) and the EU Dual-Use Regulation 2021/821 of May 2021. Some countries have published national dual-use lists.

Export control authorities use these product classification numbers to assess whether a specific export license is required. The level of control and scrutiny varies based on the product’s classification, with more stringent measures applied to goods of greater sensitivity.

Export Control Classification Process

Exporters are typically responsible for self-classifying their products based on established classification systems. This process requires in-depth knowledge of the product’s specifications, technical characteristics, and potential applications.

In some cases, Government involvement ensures consistency and accuracy in the classification process, as government authorities may provide assistance or make final determinations regarding product classification.

Conclusion

In the dynamic landscape of international trade, standardized classification systems such as the Harmonized System (HS) code are indispensable tools. These systems not only simplify the global movement of goods but also contribute to regulatory compliance, customs efficiency, and the overall stability of the international trade environment. Understanding and effectively utilizing these classification systems are vital for businesses, governments, and other stakeholders engaged in the intricate tapestry of cross-border commerce.